So this made me want to think about what was motivation my insurance agent/ financial adviser. As I always wondered whether they were truly looking out for my best interests or their own and what is motivating them in to purchase this policy type over another.

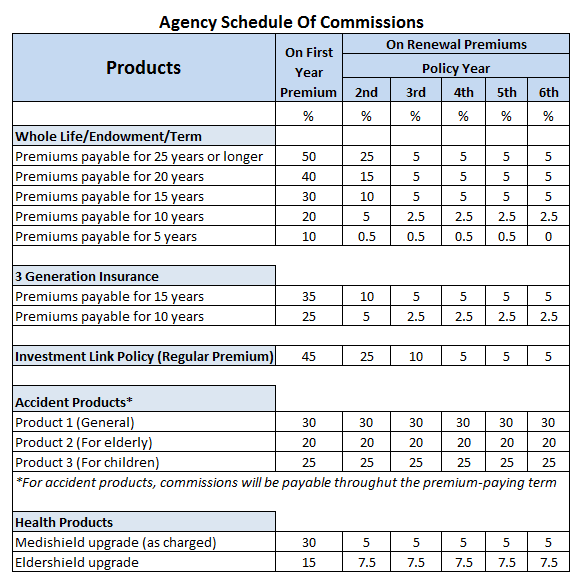

So after some quick research on Google, I came across these two interesting links. Here's a quick table I found on some possible commissions that you could earn as a insurance policy agent. If you're interested in a career in insurance, depending on how well you can sell, then it may be a good career path for you ;)

Note: please note that the Singaporean Government is looking to change the commissions/ payment structure for insurance agents. But it's always good to know how things are (and maybe soon to be 'were').

Commission structure of insurance agents

A good insight into possible commissions based on the term and type of product sold. Not too bad if you manage to sell to someone who can stick with the plan for the long run (at least six years for this company - based on the 6th Policy year % commission earned).

|

| Commission structure of insurance agents in Singapore Source: "$1Million Personal Financial Diary" Blog, http://onemilliondiary.blogspot.sg/2012/10/commission-structure-of-insurance.html?m=1 |

Well, as a buyer of insurance, I hope this helps enable you to have an understanding of why certain products may be pushed more than others to you.

Related posts:

Public transport - EZLink card, NETS FlashPay cards what are the differences?

The basics

Finances - Banking in Singapore - What to know when selecting a bank account

Finances - Share trading in Singapore - How to get started